Amount Due to Director Journal Entry

Partners Capital Ac to be credited if capitals are fluctuating. A Directors Loan is when you take money from your business that isnt a salary dividend or expense repayment and youve taken more than youve put in.

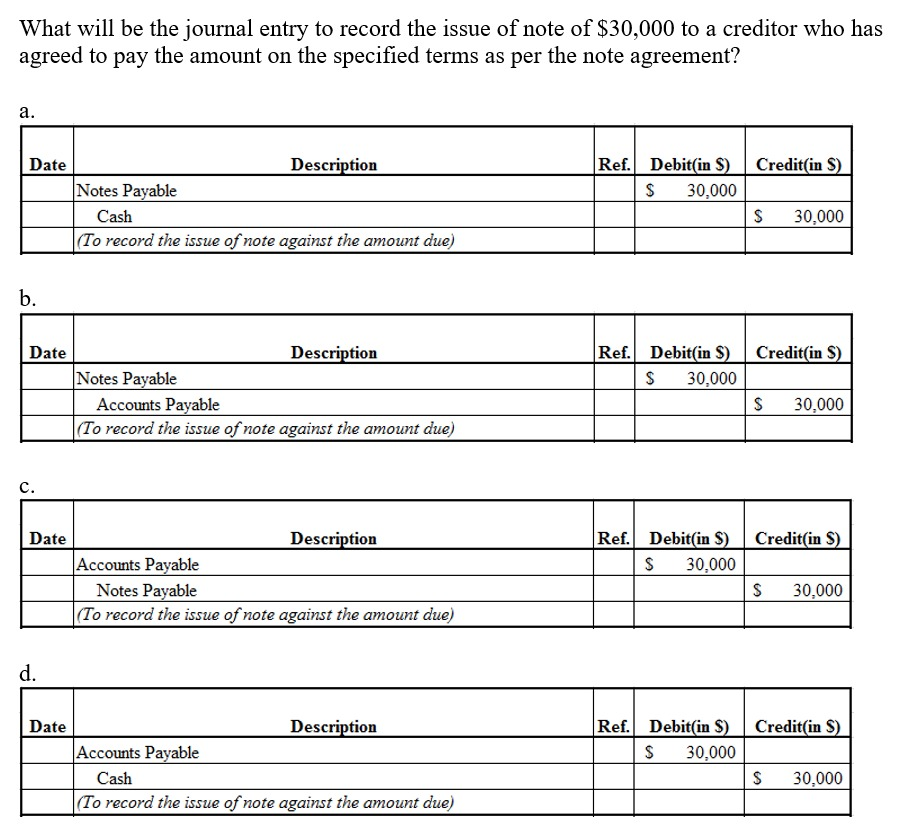

Solved What Will Be The Journal Entry To Record The Issue Of Chegg Com

As the company makes payment at the end of the month so they can make journal entry by debiting salary expenses and credit cash of 11000.

. The relevant journal entry for credit that is due from customers is as follows. If the loan was made to an unquoted trading company the individual will crystalise a capital loss equal to the amount of the loan written. Company 1 purchases goods from Company 2 on account credit.

The funds can be short term or long term which means they due within one year or due at any point in time in the future. Please prepare the journal entry for the January salary expense. Step 1 Journal entry for salary due.

However due to the payment process and cash flow issue the payment is delayed. Best Boots buys an office printer for Designer Doors for 22000. Official Site Run Your Whole Business.

You must keep a record of any money you borrow from or pay into the Company and this record is usually known as a directors loan account. 1purchase ac Dr20000 To ram 20000 Goods purchased on credit 2ram Dr. Therefore these journal entries are created in order to showcase the amount that is due from customers.

The amount due from the customer has been posted to the accounts. Ends up paying less PAYENIC. 2Cash paid to ram rs.

It increases from prior month due to new staffs. Company ABC has 3 executive directors and 2 non-executive directors. It is the amount of funds due to another party and is found in the general ledger.

1 Home DR Home CR Home Balance BALANCE. For example suppose a business has an amount of 1000 owed by a customer for services provided on account but also has an amount of 200 due to a supplier in this case the customers business for goods it has purchased. Say if his normal net pay is 1000 co will pay him 900100 so he is not losing out.

Now lets take an example in order to answer that question. Partners Current Ac to be credited if capitals are fixed in nature. On 20 April the company has made a payment of 50000 to all directors.

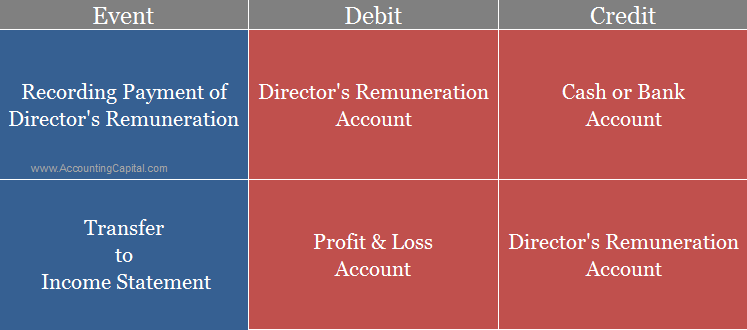

The journal entry is debiting salary payable 50000 and credit cash 50000. Journal Entry For Director S Remuneration Accountingcapital Chapter 15 Company Accounts. Amount due to Director.

- Line 1 chose Directors Loan account and entered the loan amount in Debits. Individual Loans written-off. Amount due from director double entry.

Journal entries for Director loan write off. After closing all the books at the end of a financial year every business starts its new books at the beginning of each year. To Partners CapitalCurrent AC.

Amount director due entry. 15000 To cash ac 15000 Cash paid to ra Continue Reading Siddhant Bahuguna. On 15 th August ABC made payment for the salary of July so they have to reverse the salary payable and cash balance.

Closing balances of all the accounts are carried forward to the new year as opening balances. On 31 January they pay a salary expense of 11000. On 01 April the remuneration committee decide to pay the 10000 to each director.

If an individual makes a loan to a company and this is subsequently written-off the company will have a non-trading loan relationship credit equal to the amount written off. Therefore it can be seen that credit that is due from customers is considered a current asset. If he takes a salary from the co pay him the normal salary less the grossed-up amount of woffso co.

Designer Doors Loan Receivableasset account Credit. Step 2 Transferring partners salary to Profit Loss Appropriation Ac. 1Purchase goods from ram for rs 20000.

Amounts due to the director from the. A contra entry journal is used to make the adjustment. The account owed could be to an individual another company an external creditor or even an internal department of the same company.

The entries for the above transaction are following. Journals are as follows. In the income statement it is described as revenue.

The loan journal entry in best boots is. Corporation Tax S455 25 of the balance of any overdrawn directors loan account still outstanding 9 months and 1 day after the end of the accounting period. As it is the first entry in the new financial year it is called Opening Journal Entry.

View Amount due from directorpdf from ACCOUNTING BBSA4103 at Open University Malaysia. AMOUNT DUE TO DIRECTOR Date Journal Type 01-01-0001 Ref. Bank asset account This loan entry goes to assets because cash is expected to be received into the bank.

Journal Entry For Director S Remuneration Accountingcapital

The Directors Decided To Offer 150 000 Ordinary Chegg Com

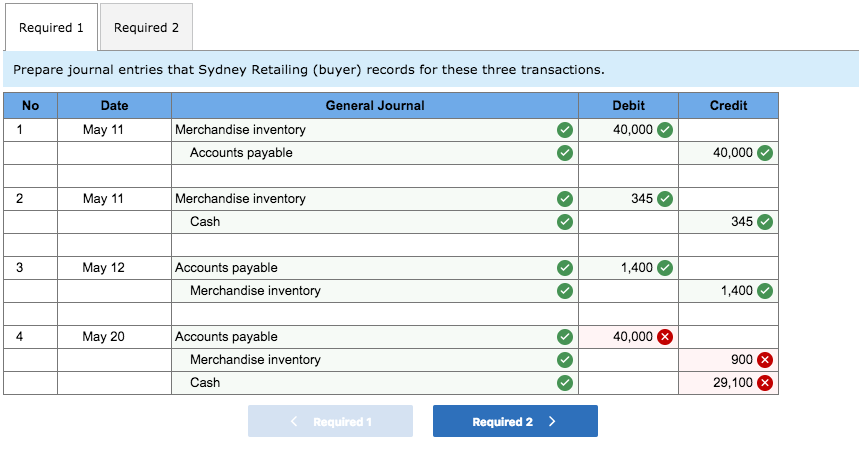

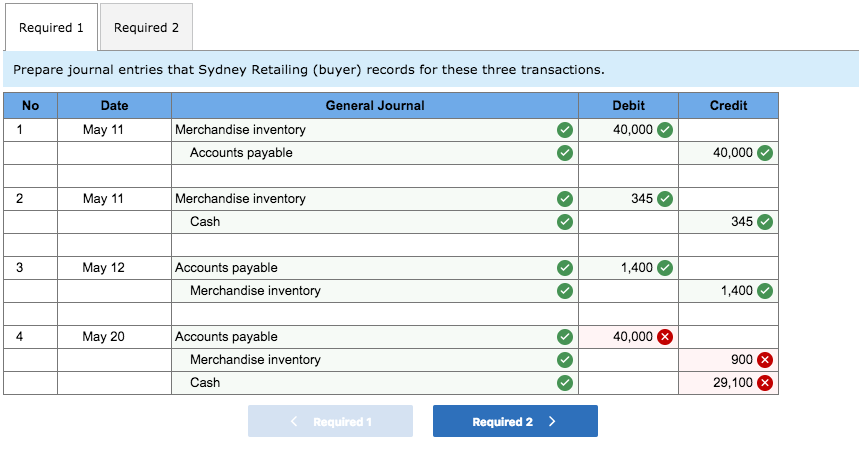

Solved Journal Entry Worksheet 2 3 4 Sydney Pays Troy Chegg Com

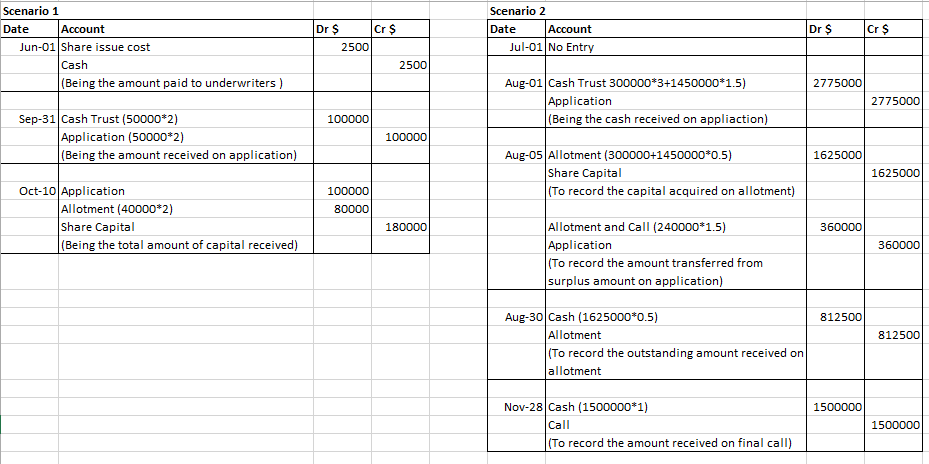

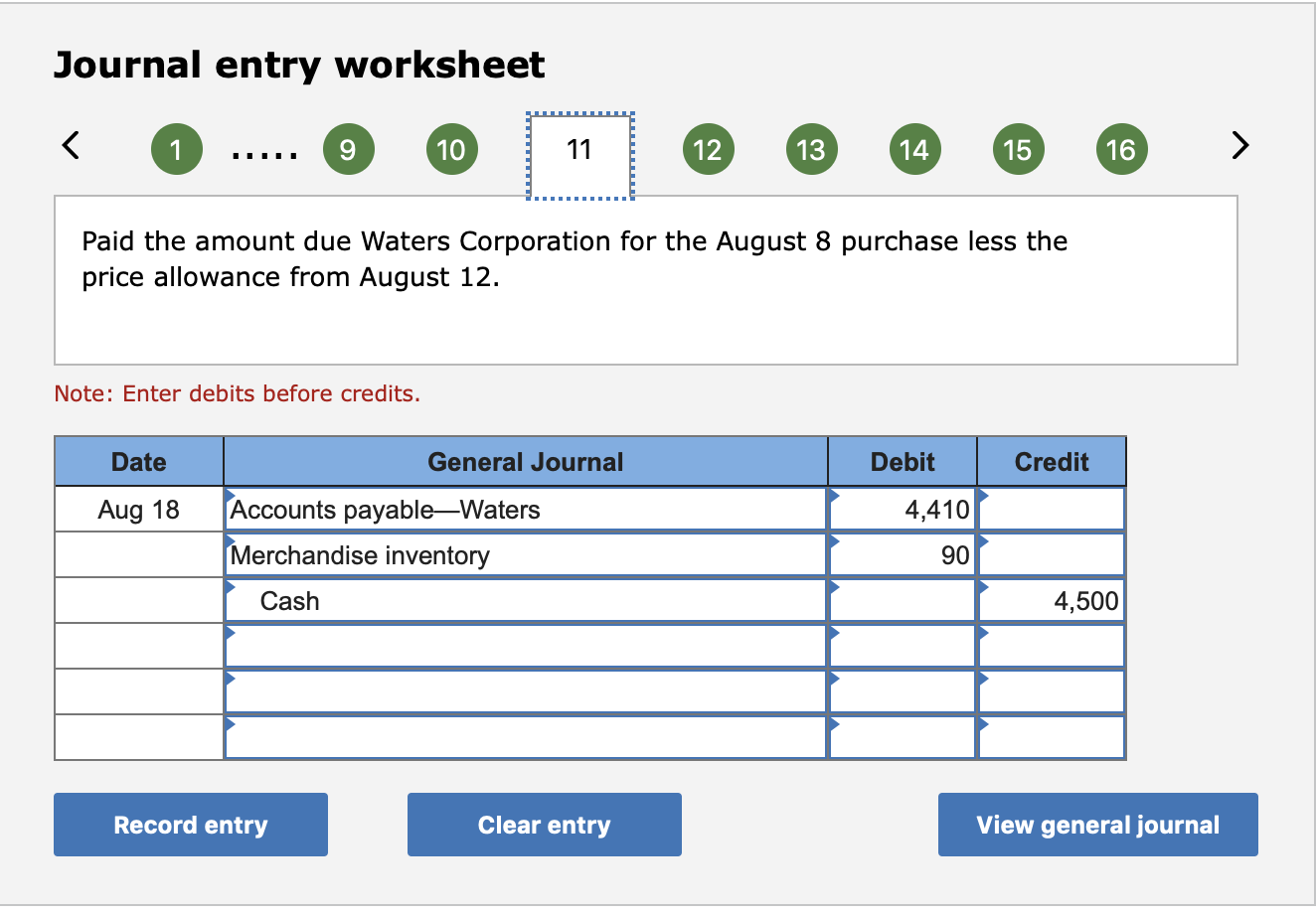

Solved Prepare Journal Entries To Record The Following Chegg Com

No comments for "Amount Due to Director Journal Entry"

Post a Comment